ELECTRICITY

ELECTRICITY TARIFFS

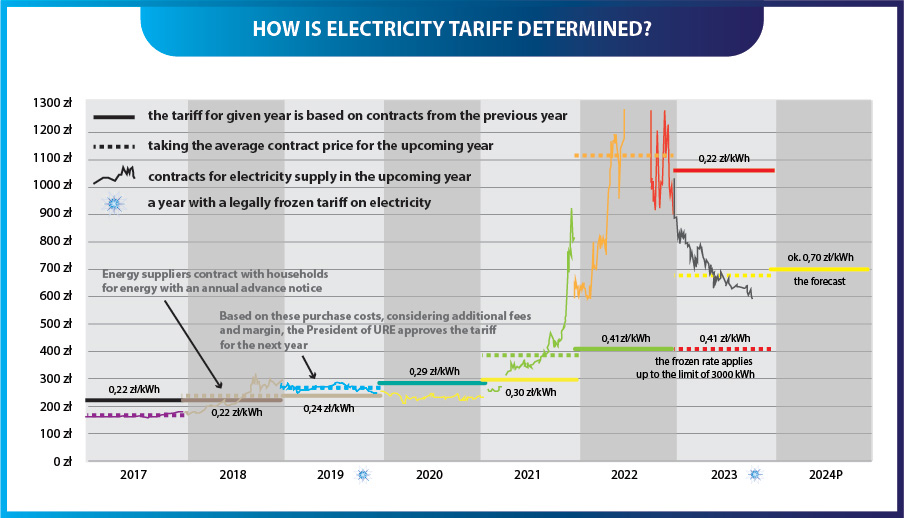

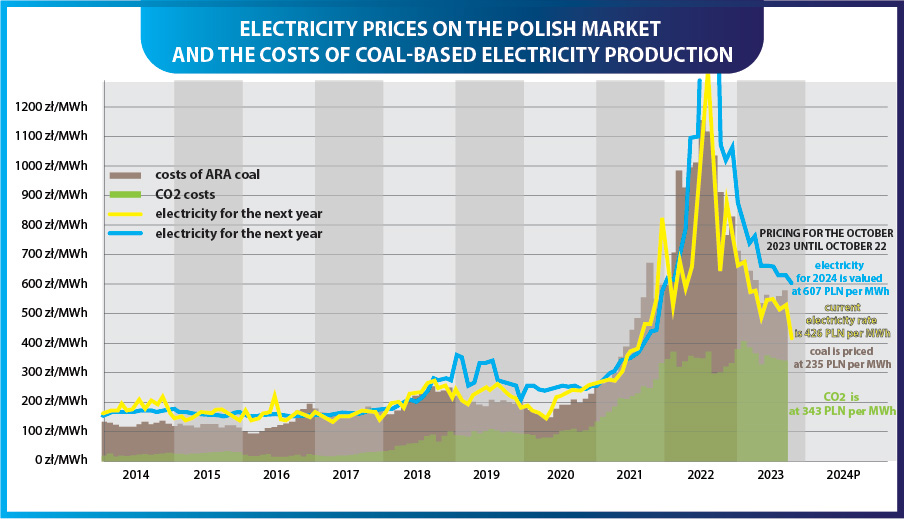

Electricity tariffs are calculated by energy companies. The President of the Energy Regulatory Office may approve or disapprove them, taking into account the “justified costs” of purchasing this energy on the wholesale market, taxes and fees, as well as the seller’s margin. In practice, tariffs are estimated based on the weighted average prices of energy in forward contracts for the next year.

From the beginning of the year until today, the weighted average price for the year 2024 is 680 PLN/MWh, or 68 groszy/kWh net. Sellers add the costs of the so-called “color certificates” and excise tax, resulting in a cost of approximately 695 PLN/MWh. Adding the company’s margin, they will propose no more than 75 groszy, and the President of the Energy Regulatory Office may consider slightly over 70 groszy/kWh as justified.

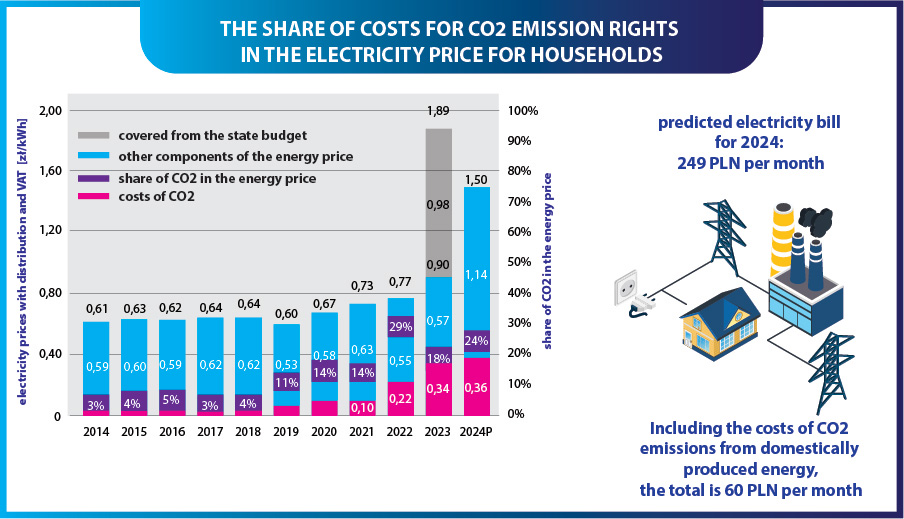

Cost Of Co2 In The Electricity Bill

The prices of coal burned in European power plants and gas were significant factors in 2022 that raised electricity prices on the market, resulting in an increase in electricity tariffs for 2023. Today, coal prices in the Polish market remain at historically high levels, but on the Polish stock exchange, they are decreasing, even below the costs of production in coal-fired power plants, including both the cost of coal and CO2. As a result, the market is increasingly experiencing an oversupply of energy, driven by photovoltaic panels and wind farms. There have been situations where we had several hours with negative energy prices, where sellers had to subsidize buyers to get rid of contracted energy or continue production. The share of CO2 is approximately 18% in 2023 and will increase to about 24% in 2024.

In the European Union, including Poland, the Emissions Trading System (EU ETS) operates, regulating greenhouse gas emissions, including CO2, in industrial and energy sectors. Companies are obliged to have emission allowances corresponding to their CO2 emissions. If they exceed their limited emission quantities, they must purchase additional allowances.

The costs of these allowances can impact electricity prices, as energy companies may pass these costs on to consumers. However, specific CO2 costs in electricity bills may vary depending on the energy provider, the type of contract (fixed prices, variable market prices), and other factors.

Large Enterprises and Manufacturing Plants

For most enterprises, rising prices of energy, fuels, and energy resources pose complications for their operations and business activities. In response to the energy crisis, businesses have increased the prices of their products and services. In the short term, enterprises respond to high energy prices by limiting production or passing costs on to the final prices of their goods. Only long-term price increases serve as motivation for investment actions. Some companies have implemented or plan investments to reduce the costs of energy carriers.

Enterprises take various actions to counter the effects of the energy crisis. Some seek cheaper raw materials, materials, and services from suppliers, and more than one-third have postponed planned investments.

A portion of enterprises has viewed market changes as an impetus to start investments that reduce energy usage. Companies decide to upgrade equipment to increase energy efficiency, invest in their own renewable energy sources, or undertake thermal modernization of buildings. The introduction of digitization and automation of production processes, a shift to cheaper and more or less emission-intensive energy carriers, and the introduction of electric vehicle fleets have been less popular initiatives.